Not known Details About Mortgage Broker Average Salary

Wiki Article

Mortgage Broker Average Salary Fundamentals Explained

Table of ContentsAbout Mortgage Broker AssistantSome Known Factual Statements About Mortgage Broker Association 6 Easy Facts About Mortgage Broker Assistant Job Description DescribedThe smart Trick of Mortgage Broker Job Description That Nobody is DiscussingThe Buzz on Broker Mortgage Near Me6 Easy Facts About Broker Mortgage Calculator ExplainedNot known Facts About Mortgage Broker Assistant Job DescriptionRumored Buzz on Mortgage Broker Association

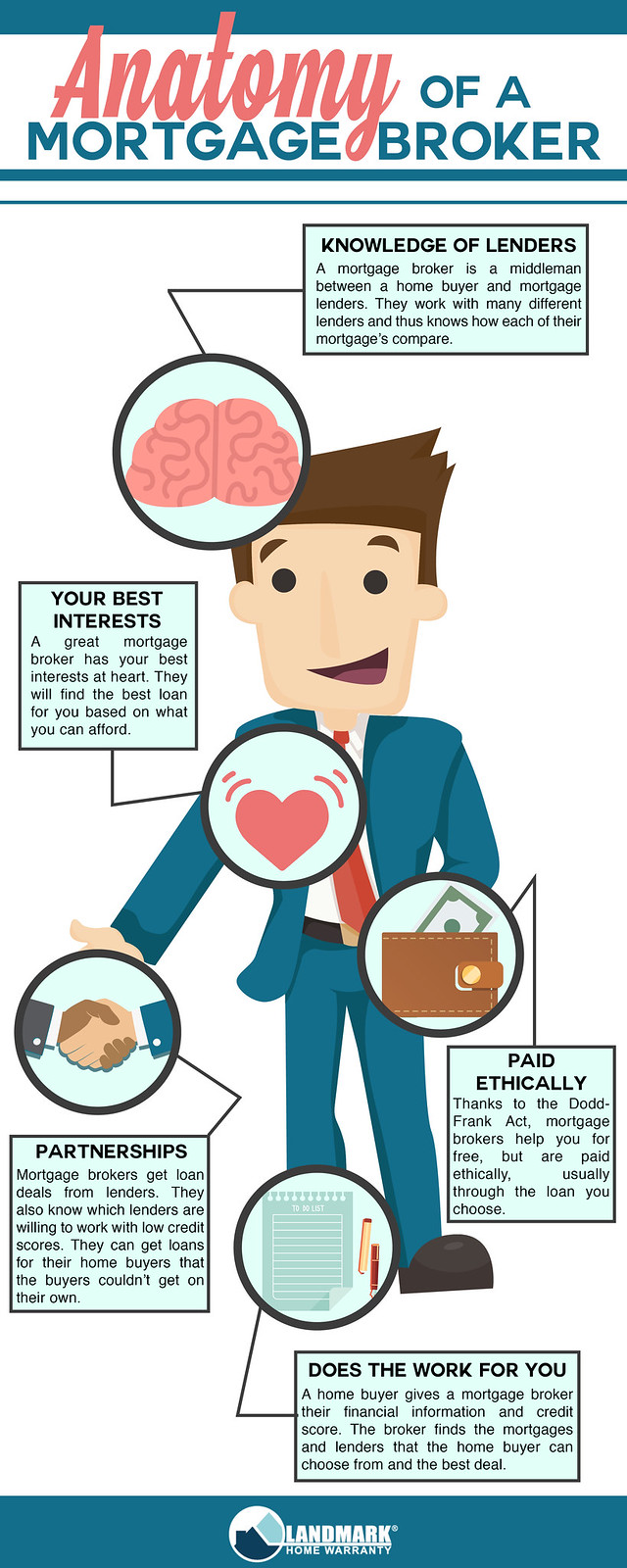

What Is a Home loan Broker? A mortgage broker is an intermediary in between an economic organization that provides loans that are safeguarded with actual estate and also people interested in acquiring realty that require to borrow cash in the type of a funding to do so. The home loan broker will certainly work with both events to obtain the private approved for the loan.A home mortgage broker typically functions with various loan providers and can supply a selection of finance choices to the debtor they work with. What Does a Home loan Broker Do? A mortgage broker intends to finish realty transactions as a third-party intermediary between a consumer as well as a lender. The broker will collect details from the private and also go to several loan providers in order to discover the most effective prospective financing for their client.

Getting The Mortgage Broker Assistant To Work

The Base Line: Do I Required A Home Loan Broker? Working with a mortgage broker can save the consumer time as well as effort throughout the application process, as well as potentially a lot of cash over the life of the loan. In enhancement, some lending institutions work exclusively with mortgage brokers, indicating that customers would have accessibility to loans that would otherwise not be offered to them.It's important to analyze all the costs, both those you may need to pay the broker, as well as any kind of costs the broker can aid you avoid, when weighing the decision to work with a mortgage broker.

How Mortgage Broker Assistant Job Description can Save You Time, Stress, and Money.

You have actually most likely listened to the term "mortgage broker" from your real estate agent or friends who have actually acquired a house. What exactly is a mortgage broker as well as what does one do that's various from, say, a financing police officer at a financial institution? Nerd, Pocketbook Guide to COVID-19Get solution to concerns regarding your home loan, travel, financial resources and also preserving your peace of mind.1. What is a mortgage broker? A home mortgage broker serves as a middleman between you as well as potential lenders. The broker's job is to compare home loan lending institutions in your place and also locate interest prices that fit your needs - mortgage broker meaning. Home mortgage brokers have stables of lending institutions they collaborate with, which can make your life easier.

8 Simple Techniques For Mortgage Broker Average Salary

Exactly how does a mortgage broker obtain paid? Mortgage brokers are most commonly paid by lenders, occasionally by borrowers, however, by law, never ever both.What makes home mortgage brokers different from lending officers? Loan police officers are staff members of one loan provider who are paid set incomes (plus benefits). Car loan policemans can write only the kinds of lendings their company chooses to offer.

Facts About Mortgage Broker Vs Loan Officer Revealed

Mortgage brokers may have the ability to provide customers access to a wide choice of funding kinds. 4. Is a home mortgage broker right for me? You can conserve time by utilizing a mortgage broker; it can take hours to look for preapproval with various lenders, after that there's the back-and-forth interaction associated with underwriting the funding and guaranteeing the transaction remains on track.However when choosing any kind of lender whether through a broker or directly you'll want to take note of loan provider costs. Specifically, ask what fees will certainly show up on Web page 2 of your Funding Price quote my link type in the Loan Prices section under "A: Source Charges." Then, take the Lending Estimate you get from each lender, position them side by side and also compare your rates of interest and all of the costs as well as shutting costs.

Broker Mortgage Rates - Truths

Exactly how do I select a home loan broker? The best way is to ask close friends and also loved ones for recommendations, but make certain they have really made use of the broker as well as aren't simply dropping the name of a former university flatmate or a remote associate.

Broker Mortgage Rates for Dummies

Competition as well as home prices will affect exactly how much home loan brokers make money. What's the difference in between a home mortgage broker as well as a car loan officer? Home mortgage brokers will certainly collaborate with numerous loan providers to find the most effective lending for your scenario. Lending officers benefit one lender. How do I locate a home loan broker? The best way to find a home mortgage broker is through referrals from family members, buddies as well as your realty representative.

Some Ideas on Broker Mortgage Rates You Need To Know

Investing in a brand-new house is just one of one of the most intricate events in a person's life. Properties differ significantly in regards to design, services, institution area and also, of training course, the always essential "area, area, place." The home loan application process is a difficult aspect of the homebuying procedure, especially for those without previous experience.

Can identify which issues may create troubles why not find out more with one lender versus an additional. Why some purchasers avoid home loan brokers In some cases property buyers feel extra comfortable going straight to a big financial institution to protect Extra resources their funding. In that situation, buyers must at the very least speak to a broker in order to understand every one of their alternatives concerning the kind of lending as well as the offered price.

Report this wiki page